Have any question? click here

-

0

Cart

Advanced analytical solution to perform risk management on capital investments, budgeting, project finance, discounted cash flows, and project economics analysis.

PEAT is one of the most powerful analytical solutions to support risk-based corporate decisions, economic assessments, project finance, and budgeting allowing professionals to value business and investments while quantifying risks. The current version contains analytics for cost and schedule risk and enterprise risk management.

Get One Month Free | PEAT

”One tool to frame and value strategic business decisions”

5/5

With PEAT, decision-makers can run Monte Carlo Risk simulations and compute Corporate Finance indicators to correctly value projects, investments and business decisions considering risk and uncertainty.

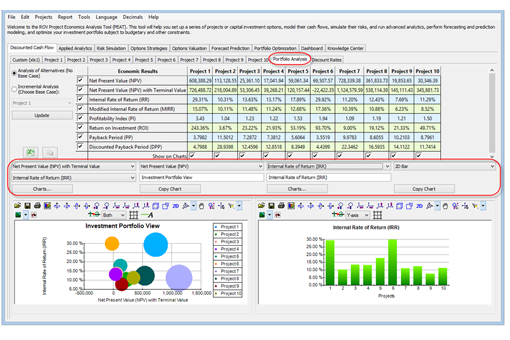

Consistent KPIs to report financial and economic information, including Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period (PB), Capital Structure, among other criteria.

PEAT has a user-friendly interface to set up the investment, project data and discount rates, run Discounted Cash Flows, and estimate Corporate Finance indicators to support decisions and value creation strategies for individual projects and options within an investment portfolio.

Analytical tools to turn project and investment data and assumptions into meaningful insights for more effective decision-making.

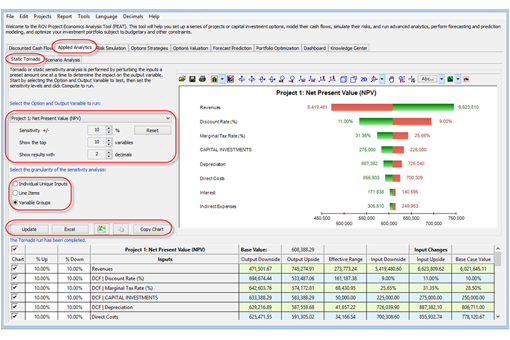

Determine the critical success factors of each project’s economic metrics, copy the chart and sensitivity results, and re-run the analysis based on your sensitivity settings-everything to guide the decision-making process.

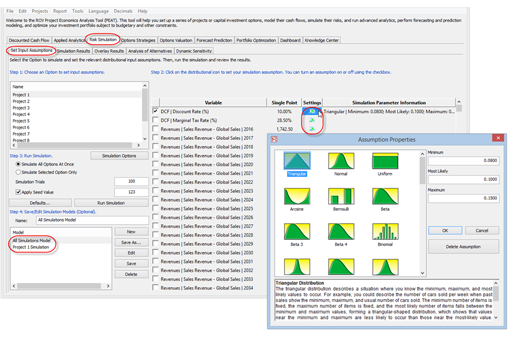

Monte Carlo simulation makes quantitative risk analysis in investment and project valuations more intuitive.

Setting up and running a Monte Carlo Simulation on Real Options Valuations takes three easy steps:

- set up a new simulation profile or change/open an existing profile;

- set input assumptions and output forecasts;

- run a simulation and interpret the results.

Perform alternative analysis based on probabilistic outcomes such as value-at-risk, contingencies, percentiles, and most likely scenarios for the main KPIs.

Compare each strategic project or option’s risk simulation results side by side as an Analysis of Alternatives or Incremental Analysis. Determine which projects provide the best outcomes and non-dominated results.

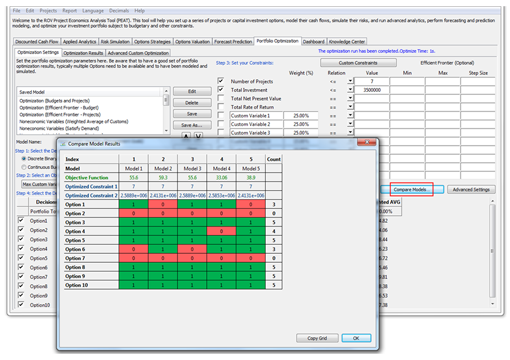

Run portfolio optimizations to effectively use resources and achieve the best investment results and asset allocation.

In PEAT, you can run portfolio optimization, compare models and results, analyze the role of financial and nonfinancial variables, and determine the influence of your constraints on project selection and value creation strategies.

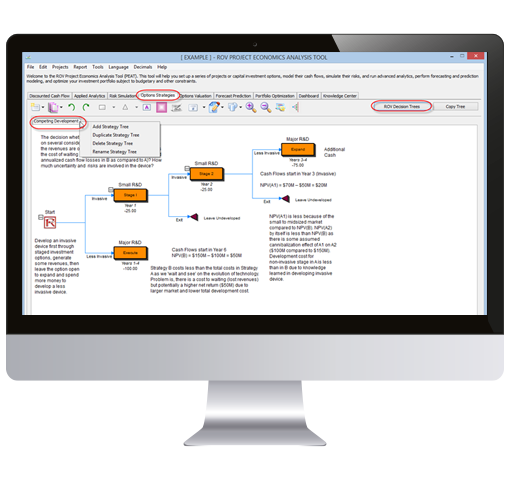

Strategy Trees and Real Options to eliminate the possibility of undervaluing the strategic value of projects, investments and business decisions by considering risk and uncertainty.

The Strategic Real Options function in PEAT takes advantage of the full range of alternatives and investment strategies (expansion, contraction, abandonment, postponement, and the like) for ROI enhancement.

FREE 30-DAY TRIAL

Get Your Trial Version

- Easy Install

- All Functionalities

Get One Month Free | PEAT

Industries and Client using PEAT

PEAT provides management with advanced risk management tools and methodologies to analyse project or investment opportunities and support business decisions.

Energy & Utilities

Aerospace & Defense

Finance & Banking

Manufacturing & Consumer Goods

Construction & Engineering

Insurance & Reinsurance

Installation Requirements (Windows)

Operating system

Windows 7, 8, or 10 (32-bit and 64-bit)

Software requirements

Microsoft Excel 2013, 2016, 2019

Microsoft Excel® for Microsoft 365 (32 and 64 bit)

Microsoft®.NET 2.0, 3.0, 3.5 or higher

Hard disk

650 MB Hard Disk Space

Permissions

Administrator rights for installation of the Software

Other

For users of the MAC OS operating system, use the software if have Bootcamp, Virtual Machine or Parallels